This article will outline the flaw in reported enterprise valuation multiples for companies with non-controlling interests and show how one might correct the flaw to arrive at a more accurate TEV and TEV multiples.

It is common for valuators, investors and other analysts to assess a company’s value utilizing enterprise valuation multiples such as TEV to earnings before interest, taxes, depreciation and amortization expense (“EBITDA”), among others. For those valuation multiples to be reliable, the TEV must be calculated in a manner that reflects the fair market value of the total enterprise. Many analysts rely on TEV and TEV multiples reported by S&P Capital IQ (“Capital IQ”) or other financial information providers. Unfortunately, the reported TEVs and TEV valuation multiples are not always consistent with fair market value. This is often true where the company being analyzed has non-controlling interests.

Where the non-controlling interest is not material and its claims on earnings and / or distributions are also not material, using book value of the non-controlling interest, while inconsistent with fair market value, will not likely result in a material misstatement. In cases where the non-controlling interests are a significant portion of the capital structure and / or have a significant claim on earnings or distributions, using book value of non-controlling interest when computing TEV could lead to a significant valuation error.

In particular, companies in the healthcare industry that are substantially based on a joint venture model are subject to this potential valuation error. Some public companies that may require further analysis include, but are not limited to each of the publicly traded ASC companies: AmSurg Corp., Surgical Care Affiliates, Inc. and Surgery Partners, Inc. TEV calculations for these and other companies that allocate and /or distribute a substantial portion of income to non-controlling interests should be carefully considered.

The most common method of computing TEV used by some financial data reporting services, including Capital IQ, is as follows:

The TEV and TEV multiples calculated in the manner above may be inconsistent with fair market value and their use may lead to valuation errors.1 The flaw in the TEV calculation above is that the non-controlling interest represents book value not fair market value.

We will use AmSurg Corp. (“AMSG”) throughout this analysis to exemplify our case. AMSG operates “257 ASCs in 34 states and the District of Columbia in partnership with approximately 2,000 physicians, and provided physician services to more than 450 healthcare facilities in 29 states, employing more than 3,800 physicians and other healthcare professionals.”2

Other important disclosures from AMSG’s 10-K relate to the structure of its operations. Specifically, it states “We generally own a majority interest, primarily 51%, in the facilities we operate. We also own a minority interest in certain centers in partnerships with leading health systems and physicians and intend to continue to pursue such partnerships.”

As a result of these 51% interests, all revenues and expenses related to such operations are consolidated into AMSG’s financials. Thus, there is profitability in the consolidated income statement that is attributable and payable to other parties, namely the 49% interest holders. The profitability allocable to third-parties results in overstated EBITDA because the distributions to the 49% interest holders are functional reductions to funds available for common equity holders.

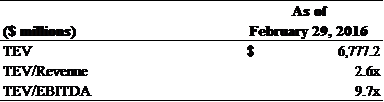

On February 29, 2016 Capital IQ reported the following TEV and TEV multiples for AMSG:

These values were calculated using the book value of the non-controlling interest. The calculation employed by Capital IQ is presented below:3

Note that the book value of the non-controlling interest comprised 9.5% of the TEV in this calculation. Generally accepted accounting principles do not require the non-controlling interest to be marked to market. As a result, the book value of the non-controlling interest likely does not reflect fair market value.

A review of AMSG’s income and cash flow statements reveals substantial income and distributions to its non-controlling interests relative to their book values. A summary of AMSG’s income statement and distributions to the non-controlling interest holders follows:

As shown previously, the book value of the non-controlling interest accounted for only 9.5% of TEV. Yet the non-controlling interest holders are allocated 57.2% of net income. From a cash perspective, distributions to the non-controlling interests for the period totaled $214.9 million or 43.3% of pretax income and 30.9% of reported EBITDA. AMSG common shareholders did not receive any dividends during the period reported above.

Clearly, the book value of the minority interest does not represent market value; therefore, TEV calculated using book value of minority interest does not represent the market value of the enterprise. Consequently, the reported TEV multiples understate the actual valuation multiples reflected in the common stock price.

Correcting the flaw

Two methods one might consider to correct the flaw described above include the Mark-to-Market Method and the Expenses Method. These two methods are described below.

Mark-to-market method

To calculate market value of TEV and the TEV multiples reflected in the stock price, the non-controlling interest would be valued in the same manner as the common stock. This is accomplished using the following formula:

The tax adjustment is necessary because the non-controlling interest in AMSG’s earnings is primarily from pass-through tax entities and these earnings have not been taxed at the entity level. This adjustment produces a non-controlling interest in earnings consistent with that of the common shareholders and, if added to the earnings available to common, would better reflect the earnings of AMSG as if all equity was valued consistently with the common equity.

In the case of AMSG, the indicated tax rate is 22.9%, when the reported tax provision of $113.8 million is divided by pre-tax income of $495.9 million. However, when the tax rate is calculated with a consistent numerator and denominator for the income available to common holders, the tax rate is higher and more consistent with statutory rates, as calculated below.

The market value of the non-controlling interest may be calculated by applying the diluted P/E ratio for the common stock to the equivalent tax-affected earnings of the non-controlling interest:

As shown below, adjusting the TEV calculation for the market value of the non-controlling interest results in a TEV of $9.2 billion, indicating a TEV/EBITDA multiple of 13.3x.

Arguably, these valuation multiples reflect the fair market value of the equity and, by implication, the TEV of AMSG as of the date in question. The adjusted TEV and resulting multiples are more than 30% greater than the TEV reported by Capital IQ. In consideration of these adjustments, the analyst or appraiser must use judgment to determine whether the adjusted market multiples are meaningful and relevant in the context of the assignment.

Expense method

An alternative method to evaluate TEV would be to treat the non-controlling interest’s distributions as expenses of the business with the equity wholly owned by the common shareholders (the “Expense Method”).

AMSG’s actual distributions to the minority interest were slightly less than the non-controlling interest’s allocated earnings in 2015. As shown below, AMSG made cash distributions to minority interests totaling 30.9% of total reported EBITDA. Treating the minority interest distribution as an expense effectively reduces the EBITDA margin from 27.1% to 18.7%.

In calculating TEV using the Expense Method, one simply eliminates non-controlling interests from the TEV calculation.

Comparative Analysis

Comparisons of the TEV and valuation multiples using the three methods described herein are shown below.

As shown above, the conventional method of computing the EBITDA multiple produces a multiple of 10.1x. If one were to treat the minority interest distribution as an expense as shown above, the economic EBITDA multiple realized by the common equity holders and the enterprise is 13.2x, which is almost identical to the 13.3x multiple indicated in the mark-to-market method.

Conclusion

When computing the TEV and TEV valuation multiples one must properly account for the market value of non-controlling interests. The methods described above may not be appropriate for every company that has non-controlling interests. Companies that have non-controlling interests on the books need careful analysis when assessing their TEVs and TEV multiples. The nature of the non-controlling interest, the magnitude of its income allocations, distributions, tax structure, term and other factors must be considered to ensure that the implied market values and multiples are meaningful for a given situation.

As an alternative to valuing a target company using market multiples derived from public companies with minority interests, one could use the implied P/E multiples for the common stock to value the equity of the subject target, then add other capital structure components. This would be most applicable in situations where the capital structure and costs of capital are similar between the target and the public companies.

Ray Nicholson

Mr. Nicholson is the managing director for CBIZ Valuation Group’s Southeast Region, with a focus on healthcare valuation. Mr. Nicholson has over 30 years of diversified business valuation experience. He has provided business valuation services in mergers, acquisitions, divestitures, gift and estate tax planning, corporate reorganizations, transfer pricing studies, bankruptcy, and litigation support. Mr. Nicholson is an Accredited Senior Member of the American Society of Appraisers (ASA) and a member of the Association of Insolvency and Restructuring Advisors from which he received Certification in Distressed Business Valuation (CDBV).

Chris Foster

Chris is a Manager in CBIZ Valuation Group’s Atlanta office. Chris provides valuation consulting and advisory services, with a focus on the healthcare industry. He has participated in dinner table conversations about healthcare issues since he was five years old, when his physician father opened an urgent and primary care clinic in rural Georgia. Chris is an Accredited Senior Appraiser (“ASA”) in Business Valuation, and he holds a Master’s in Taxation from Georgia State University and a Bachelor’s in Finance from the University of Georgia and a member of the Georgia Association of Health Executives, Healthcare Financial Management Association and the North Georgia Medical Managers Association. He can be reached at Christopher.foster@cbiz.com or at (770)858-4476.

1 For this article we will not address arguments for or against using market value of debt or market value of preferred stock in computing TEV.

2 AMSG 10-K filed February 25, 2016.

3 Although we relied primarily on Capital IQ for this analysis, this issue is not unique to Capital IQ, and in our experience is prevalent in all financial databases that utilize SEC filings as the source of data.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker’s Hospital Review/Becker’s Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.L