A good place to start is by considering the patient journey and the many, often disparate factors that contribute to the overall cost for a given course of care. To healthcare professionals, it may seem obvious that surgeon’s fees, facility costs, anesthesia services, post-procedure rehab, medicine, equipment and supplies, and so on are all distinct elements provided by often unrelated sources, each with its own associated fees, invoices and financial policies. To patients, however, these separate EOBs, fees and invoices can feel like an ongoing bombardment, often hitting when they want and need to be focused on recovery. Layer on premiums, deductibles, co-pays and other out-of-pocket costs, and navigating these bills — let alone paying them — can feel overwhelming.

Given this situation, it’s no surprise that a recent report found 67 percent of providers said their primary revenue cycle concern is patient receivables.[i] Delivering a better patient financial experience can have a tremendous positive impact for patients and providers alike, making this truly a win-win.

Communicate early, clarify often

A better financial experience needs to start with patient-centric pre-surgical communications. Patients may not know the ins and outs of a typical outpatient procedure, including the specialists involved, recovery process and timing, and how and what they will be billed. One way to help provide this understanding is to empower patient access teams and scheduling and pre-op call representatives to act as a kind of “concierge” for the surgery center. They should focus on confidently sharing information and answering questions while conveying an air of confidence along with a dedication to service and support. Often these teams are the only point of contact with the patient, so they need to be comfortable delivering critical information consistently, as well as projecting calm and capably fielding a wide range of questions while managing varied personalities and stress levels.

This may not be a natural mindset for some staff members, but it may help to know that patients actually welcome information on costs and payments, and they want to engage in financial discussions. In a recent study, 88 percent of consumers said they want to understand payment responsibility up front.[ii] Offering cost estimation tools or fee schedules is useful, but simply prioritizing financial conversations and sharing cost information of any kind can help patients understand their out-of-pocket obligations and plan for any fees they may need to cover before, during, and after surgery.

For many patients, the total cost of their surgery care will involve a mix of fees covered by insurance and bills they will need to pay out of pocket. Health insurance policies are often complicated, and many patients may be reluctant to admit they don’t fully understand their coverage. It may be a relief to have someone walk them through the process and help them better understand who is providing care, their affiliations and network status, and any associated costs, as well as what this all means in terms of deductibles, co-pays and other obligations. In turn, this can mean faster payment for your ASC, streamlined A/R, and increased patient satisfaction.

More options to manage balance billing

In some situations, due to the nature of their procedure, insurance coverage details, or other factors, billing and collecting post-surgery balances is required. Given that 70 percent of patients say they are confused by medical bills, receiving a post-surgery invoice—especially one that may be unexpected, or larger than anticipated—can be problematic.1 In turn, ASCs and other healthcare professionals may struggle to collect full payment in a timely fashion. According to one survey, 77 percent say it takes a month or more to collect any payment.1 Between claims submissions, denials, billing and collecting payments, it can take a substantial amount of time to see revenue. On top of these administrative variables, patient needs, preferences and expectations can make it hard to create a process or system that meets both business and patient needs.

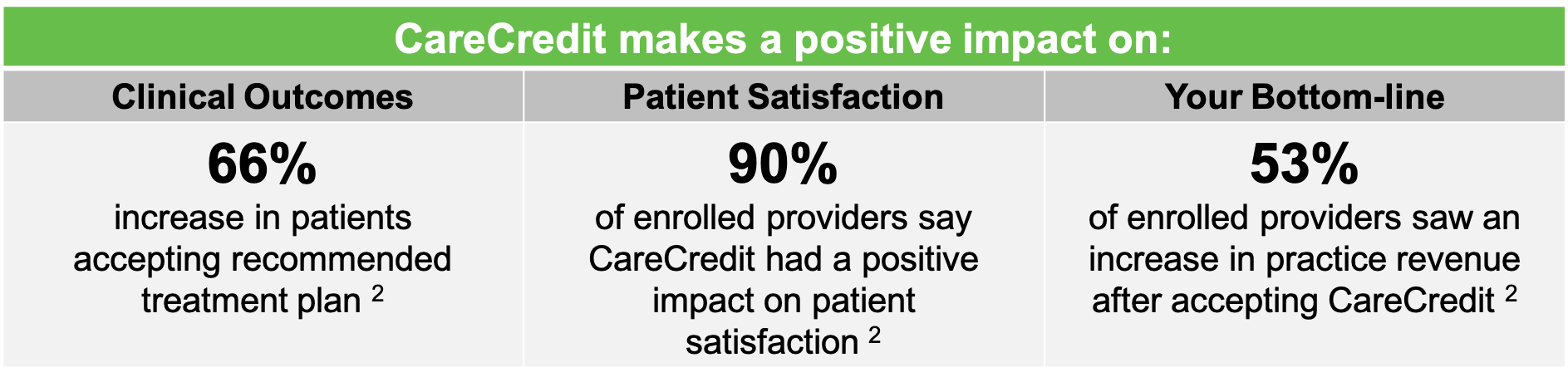

In addition to helping patients understand and anticipate their Making the patient financial experience a win-win 2 Executive Briefing By CareCredit 1InstaMed Trends in Healthcare Payments Ninth Annual Report: 2018, Published April 2019 financial obligations, ASCs can improve the financial experience by helping patients better prepare to meet those obligations. Offering more payment options can help provide a sense of choice and control, and it may make it easier for patients to fit payments into their budgets. For example, a third-party payment solution like CareCredit — a dedicated health, wellness and personal care credit card — means patients won’t have to cover their costs with cash up front, or use the cards they may rely on for life’s other expenses.* In addition, promotional financing available through CareCredit means cardholders can meet their payment obligation immediately, while making monthly payments over time to pay down the balance. Providers receive payment in two business days, with no recourse if the patient delays payment or defaults.** When patients can get the care they want and need today — and providers can receive payment without delay — the financial experience is better all around — truly a win-win.

CareCredit – Bridging the gap between payment and care

For more information, please visit carecredit.com/beckers.

[i] InstaMed Trends in Healthcare Payments Ninth Annual Report: 2018, Published April 2019

[ii] InstaMed Trends in Healthcare Payments Ninth Annual Report: 2018, Published April 2019

*Subject to credit approval. Minimum monthly payments required. See carecredit.com for details.

** Subject to the representation and warranties in your Agreement with CareCredit, including but not limited to only charging for services that have been completed or that be completed within 30 days of the initial charge, always obtaining patient’s signature on in-office applications and the cardholder’s signature on the printed receipt.