For the past six years, HealthCare Appraisers has surveyed the surgery center industry to determine trends in both the value of ownership interests in surgery centers and management fees charged to surgery centers. This year's survey had 18 respondents representing more than 500 surgery centers across the United States.

Background on respondents

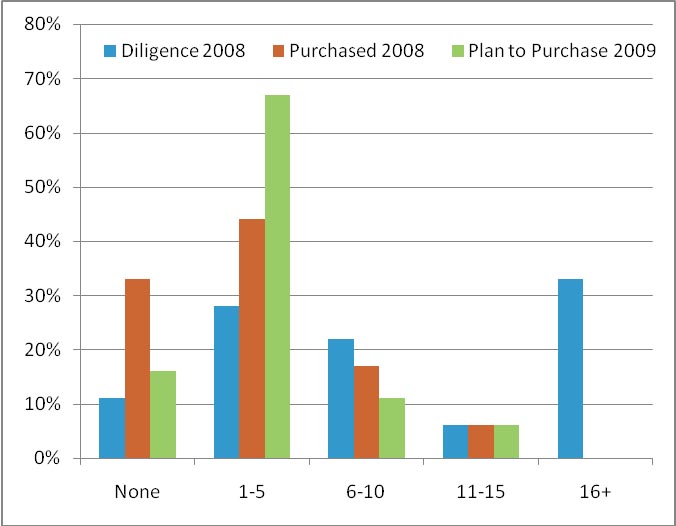

During 2008, the respondents were actively involved in searching for potential acquisitions; 33 percent performed diligence on more than 16 different centers and 61 percent performed diligence on more than six centers. While the companies were active in looking for deals, 2008 was consistent with 2007 in that eight companies only closed 1-5 deals and three companies closed 6-10 deals. However, in 2008, one company claims to have purchased between 11 and 15 surgery centers. In 2009, 67 percent of respondents plan to close 1-5 deals, while two respondents plan to close 6-10 deals and one respondent hopes to close 11-15 deals.

Start-up or purchase

When developing a new surgery center (i.e., de novo), 56 percent of respondents have experienced “buy in” prices $10,000-$15,000 per 1 percent. The respondents were fairly evenly spread on the percent interest that they are looking to purchase in a given center between 11-29 percent, 30-50 percent, and 51-75 percent .

With regard to the respondents’ strategies, 61 percent are looking for de novo opportunities, 44 percent are looking for turnaround opportunities and 44 percent are looking for established cash flowing centers. The percents do not equal 100 percent as some of the respondents are looking for multiple forms of opportunity.

Within the bidding process, the respondents are almost evenly split on the number of companies involved in the bidding process between 1-2 bidders and 3-4 bidders.

When purchasing an interest, 63 percent of the respondents fund their acquisitions through debt while 37 percent fund through cash. In deciding to make an investment, 56 percent of respondents would consider a purchase regardless of the buy-in price while 25 percent would not consider an investment more than $2 million.

Overall, 88 percent of the respondents would be interested in any deal if the terms were reasonable while the remaining 12 percent have certain markets they are concentrating in developing.

Surgery center operations

When developing or purchasing a single specialty surgery center, 61 percent of respondents prefer to have 6-10 active physicians. For multi-specialty surgery centers, 33 percent prefer 11-15 active physicians while 44 percent prefer 16-20 active physicians.

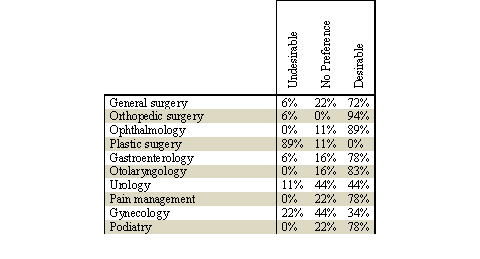

Within the 2008 survey, and given the impending changes in Medicare reimbursement, it appeared that gastroenterology may not have been as preferred as in previous years. However, the results of the 2009 survey indicate that GI is once again among the most preferred specialties. Other preferred specialties include general surgery, orthopedic surgery, ophthalmology, ENT, pain management and podiatry. For urology, the respondents were almost evenly split between desirable and not having any preference; a reduction from 2008 when 62 percent preferred having urology involved in the surgery center.

Almost 50 percent of the respondents wrote in the preference of having spine and/or neurospine involved in their surgery centers. One respondent was interested in involving bariatric surgery in surgery centers.

Plastic surgery remains undesirable. While in 2008, plastic surgery was 15 percent desirable; in 2009, not a single respondent desired plastic surgery involvement in their ASCs.

Operating agreement

When buying out a retiring or under-performing physician, 82 percent of respondents use a formula. When allowing new physicians to purchase an interest in the ASC, only 56 percent of respondents use a formula, 22 percent allow the board to decide the purchase price and 17 percent get an independent fair market value opinion.

Multiples

Reflecting back on the results of 2008, 56 percent of respondents feel that acquisition activity in the ASC market is declining while only 17 percent believe that activity has increased. Along the same line, 33 percent of respondents feel that competition for the purchase of an interest in an ASC has declined, 22 percent feel that competition has increased and the remaining 45 percent believe competition is fairly consistent.

When determining multiples and valuing a potential acquisition, 88 percent of respondents measure earnings based on earnings before interest, taxes, depreciation, and amortization (EBITDA). In valuing a potential acquisition candidate, 81 percent look at trailing 12 months of financial data.

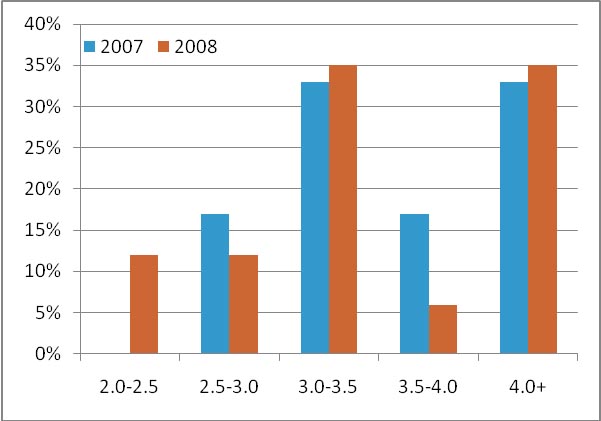

As displayed in the following graph, when buying out retiring or under performing physicians, 35 percent of respondents are paying between a 3.0-3.5 multiple of EBITDA while another 35 percent is paying a multiple of 4.0 times or higher.

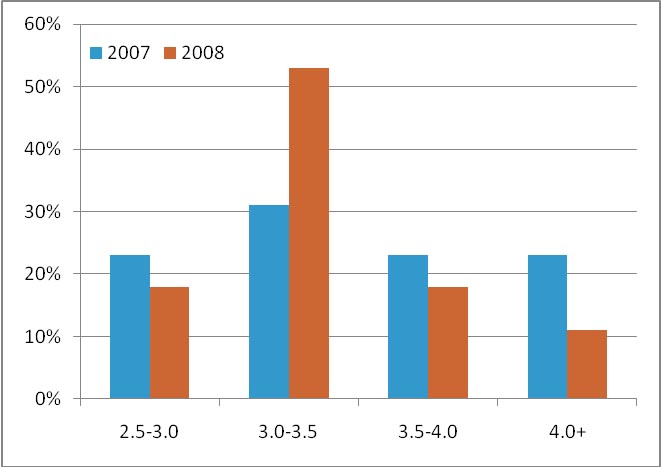

As displayed in the following graph, when selling a minority interest to new physicians, 53 percent of respondents are selling the interest at a 3.0-3.5 multiple of EBITDA. On average, 47 percent of respondents needed 3-6 months to identify a buyer and consummate a sale when selling a minority interest to new physician investors; 24 percent required less than three months and another 24 percent required six months to a year.

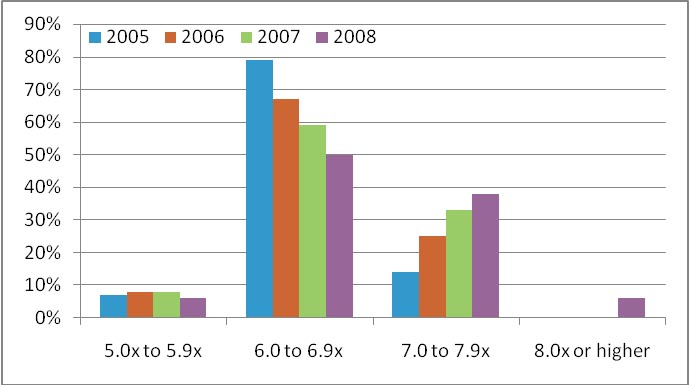

On average, and as displayed in the following graph, when purchasing a controlling interest in a surgery center, 50 percent of respondents paid between a 6.0-6.9 multiple of EBITDA, while 38 percent paid between a 7.0-7.9 multiple of EBITDA. Of the respondents, 44 percent felt that multiples have stayed consistent with 2007 while 38 percent felt that multiples have decreased.

Other considerations

For a surgery center with hospital ownership, 53 percent of respondents would not adjust the multiple paid because of the hospital ownership, 24 percent would pay a premium and 18 percent would pay a discount.

For surgery centers in certificate of need states, 88 percent of respondents would pay a premium. The premium would be equal to 0.26-0.50 times EBITDA according to 31 percent of respondents or between 0.51-0.75 times EBITDA according to 38 percent of respondents.

For surgery centers with out-of-network strategies, 75 percent of respondents felt that this strategy creates additional risk, which would be accounted for through a downward adjustment to value, while the remaining 25 percent would have to know the extent of out-of-network contracts before forming an opinion on its effect on value.

Management

Of the respondents, 67 percent maintain an equity interest in all surgery centers they manage. However, 47 percent of the respondents would consider managing a surgery center in which they do not have an equity interest.

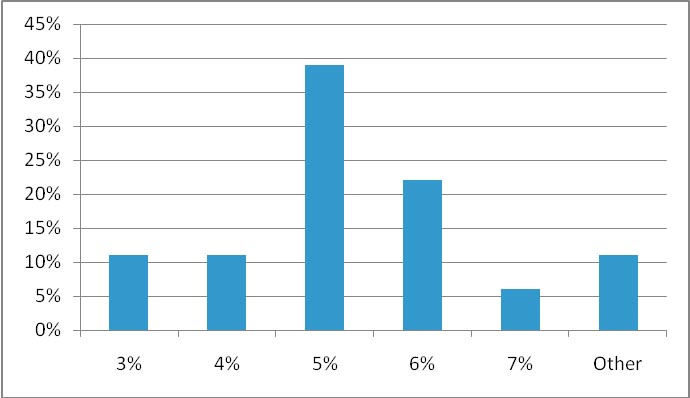

In the context of pricing management services, 39 percent would charge no less than 5 percent of net revenues while 22 percent would charge no less than 6 percent of net revenues. In the context of setting a ceiling on management fees, 56 percent of respondents would charge no more than 6 percent of net revenues and 22 percent would charge no more that 7 percent of net revenues.

In the context of pricing management fees relative to center revenues, 67 percent of respondents stated that a center’s revenues have no impact on the magnitude of management fee charged while the other 33 percent would vary their fee or using a sliding scale for centers with high net revenues.

With regard to the level of services provided in connection with the management agreement, 61 percent would customize their management fee based on the level of services provided while 39 percent would not.

With regard to the correlation of management fees and equity investment, 87 percent of respondents would not change the management fee based on the level of equity owned in the center.

If the respondents do not have an equity interest in the surgery center they are managing, 46 percent would not adjust their management fee, 15 percent would decrease their fee by 2 percentage points and 31 percent would increase their fee by 2 percentage points.

Since hospital outpatient departments typically generate higher net revenue per case than their freestanding, independent counterparts, HealthCare Appraisers inquired as to the impact management of a hospital might have on the magnitude of management fees charged. Fifty percent of the respondents might change their management fee when managing a hospital department as opposed to a freestanding surgery center depending upon the level of services required, 43 percent would not change their fee and for 7 percent it would depend upon the net revenue level of the department.

Of those willing to adjust their management fee for a hospital-based department, 50 percent would adjust management fees by 1.0-1.5 percentage points, 33 percent would adjust fees 0.51-1.0 percentage point and 17 percent would adjust fees 1.51-2.0 percentage points.

Note: HealthCare Appraisers would like to thank the following companies for their participation in this year's survey:

- Ambulatory Surgical Centers of America

- ASC Strategies

- Ascent Partners

- Community Care

- Covenant Surgical Partners

- HealthMark Partners

- Meridian Surgical Partners

- National Surgical Care

- Nikitas Resource Group

- NovaMed

- Nueterra Healthcare

- Practice Partners in Healthcare

- Regent Surgical Health

- Surgical Care Affiliates

- Symbion

- The Bloom Organization

- The C/N Group

- Titan Health Corp.

To obtain a copy of this year's survey, call or e-mail Curtis Bernstein with HealthCare Appraisers at (303) 688-0700 or cbernstein@hcfmv.com.

Learn more about HealthCare Appraisers.